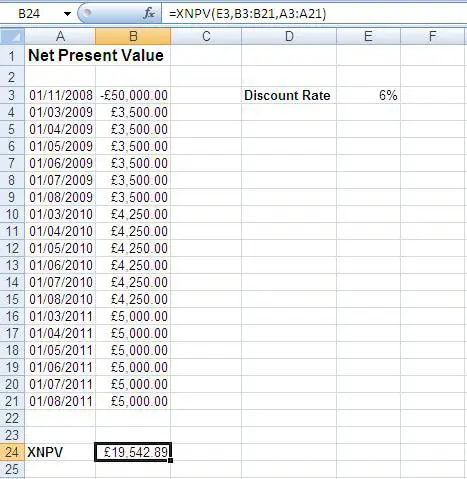

The Excel XNPV function returns the net present value of an investment based on a series of cash flows, the dates of the cash flows and a discount rate.

The syntax for the XNPV function is:

=XNPV(rate, values, dates)

| Argument | Purpose |

|---|---|

| rate | Discount rate to apply to the cash flows of the investment |

| values | Series of cash flows that correspond to a schedule of payments. The series of payments must contain atleast one negative and one positive value |

| dates | The schedule of payment dates that correspond to the cash flow payments. The first payment date occurs at the beginning and all other must be later than this date |

The example below shows the XNPV function being used to return the net present value for an investment with a discount rate of 6%, a series of payments in range B3:B21 and a schedule of dates in range A3:A21.